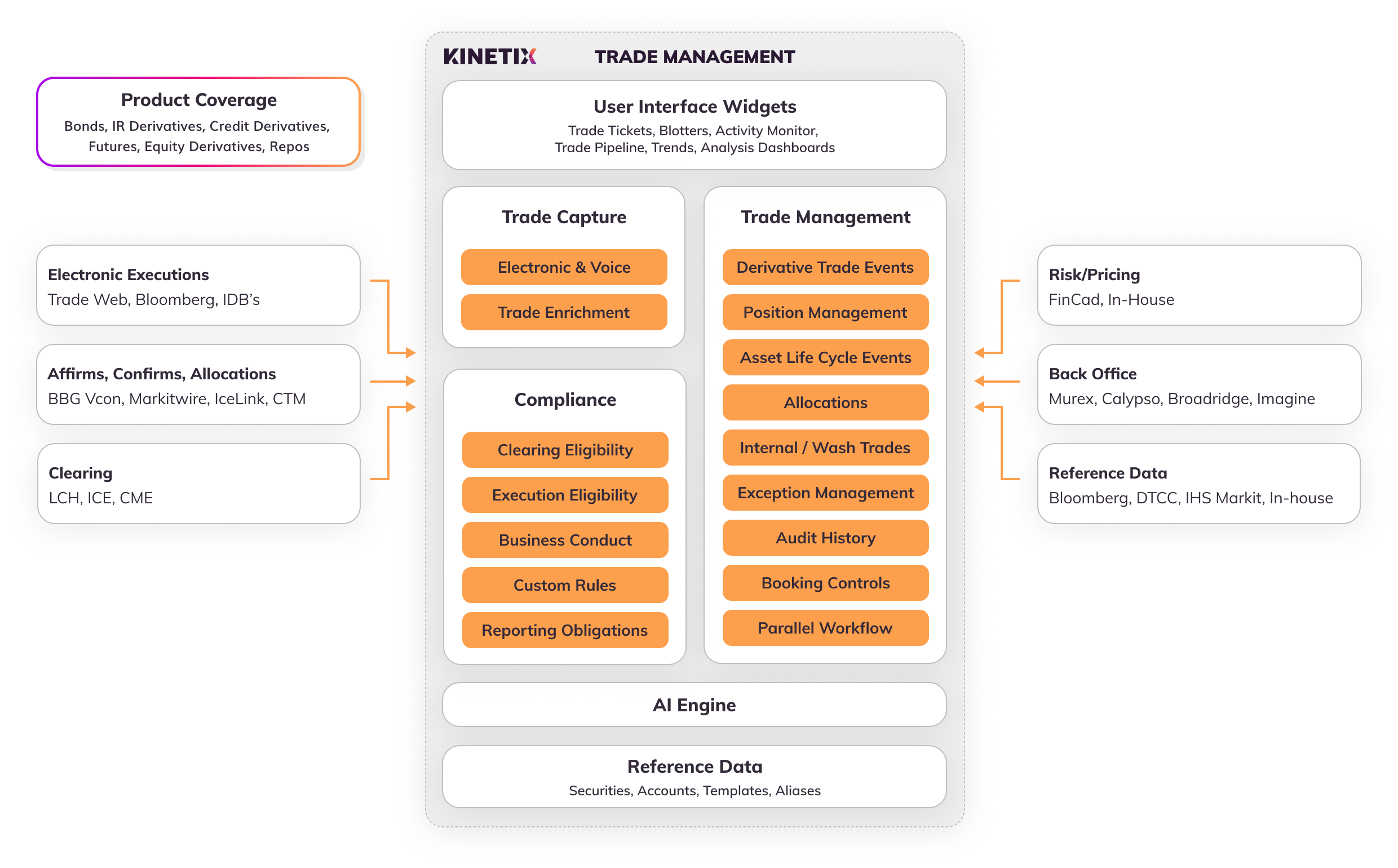

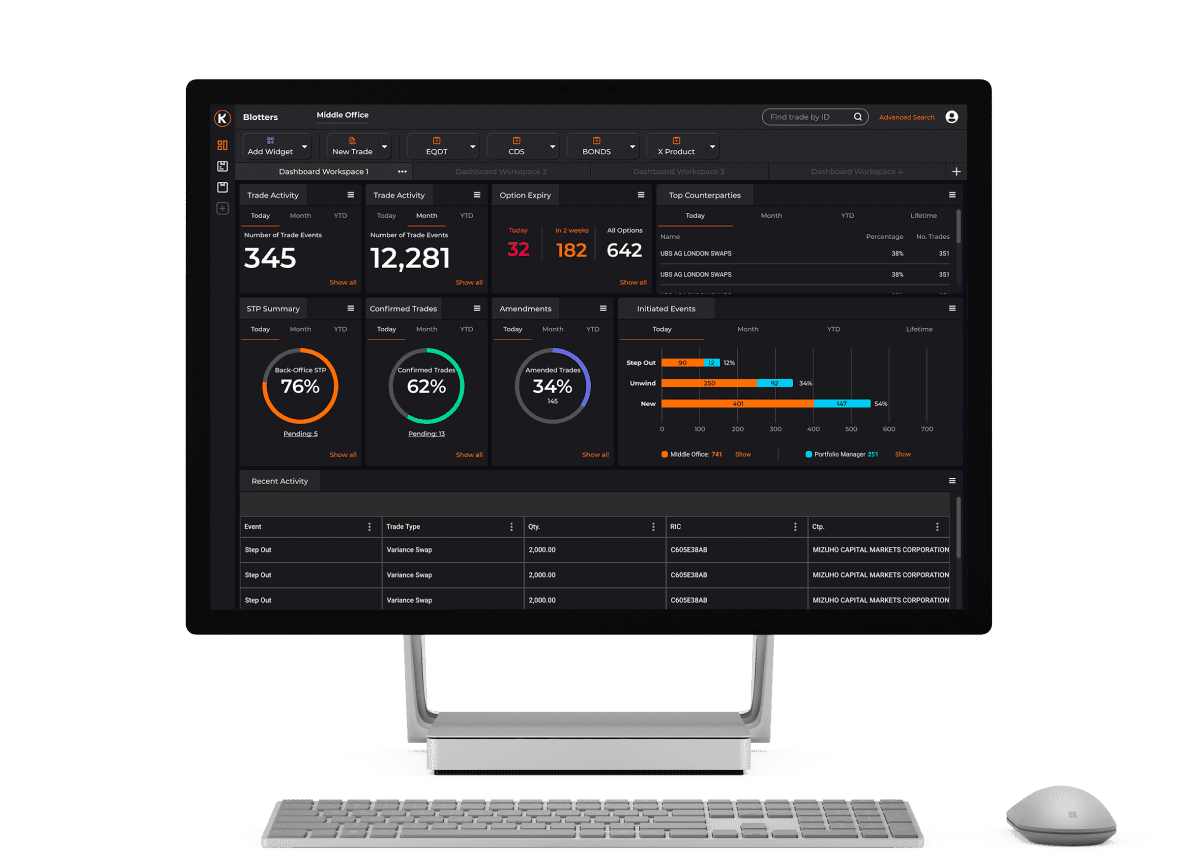

Kinetix simplifies and improves every step of trade management across asset classes by offering task-oriented, modular software for trade capture, position management, post-trade event processing, confirmation, downstream integration and regulatory compliance.

Unlike its competition, Kinetix is architected to avoid cumbersome, multi-year replacements by providing components that are easy to customize, integrate, and deploy to a wide variety of clouds and platforms.