When a major market event, such as a bank bankruptcy, shakes the financial world, the shockwaves are felt across the banking sector. For banks that are signatories to International Swaps and Derivatives Association (ISDA) agreements, particularly those with Additional Termination Events (ATEs), the situation can quickly escalate into a frantic scramble. Here’s how the chaos unfolds:

Navigating the Market Storm: How Intelligent Document Processing Helps Banks Manage ISDA Agreements during Major Market Events

The Market Chaos Triggered by a Bank Bankruptcy

Immediate Scrutiny of Counterparty Exposure:

The first concern is to assess the exposure to the bankrupt entity. Risk management teams rush to locate and analyze all ISDA agreements involving the counterparty. Identifying all relevant agreements is crucial to determine immediate actions.

Invocation of ATEs:

ATEs are unique to ISDA agreements and provide an additional layer of risk management. However, the triggers for these events often vary and can be quite specific. Teams must locate and review all clauses to identify potential triggers, such as changes in credit ratings, jurisdictional issues, or other credit events.

Assessment of Close-out Rights:

Legal and trading teams need to evaluate close-out rights, whether they should be exercised, and their implications. This requires accessing agreements quickly and understanding specific terms.

Netting and Set-off Calculations:

Before closing out trades, netting and set-off clauses must be considered to minimize risk. Finding all agreements with applicable netting sets requires rapid identification and organization.

Collateral Management and Margin Calls:

- Valuation of Collateral: During bankruptcy, the value of collateral posted under ISDA agreements can fluctuate significantly. Teams need to promptly locate and value all collateral, including initial and variation margins.

- Rehypothecation Risks: Agreements often contain terms on rehypothecation rights. Banks must evaluate the risk of rehypothecated collateral being tied up in bankruptcy proceedings.

- Margin Calls and Disputes: Bankruptcy can lead to margin calls or disputes over margin calculations, making it crucial to quickly understand collateral terms and establish accurate valuations.

Notification and Documentation Requirements:

Invoking ATEs or close-out rights often involves strict notification requirements. Legal teams must promptly send notices, following the agreed procedures in each ISDA agreement.

The Challenges

- Manual Document Review: Locating and reviewing thousands of ISDA agreements manually is time-consuming and error-prone.

- Complex and Non-standard Clauses: ATEs and other clauses vary significantly, making it challenging to find specific triggers.

- Fragmented Documentation: Documents may be stored across multiple systems and locations, leading to delays in information retrieval.

How Intelligent Document Processing (IDP) and Agreement Digitization Help

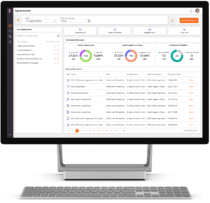

This is where IDP and agreement digitization, like those offered by Agreements IDP for ISDAs, come into play:

- Rapid Document Retrieval and Organization: IDP solutions use machine learning to classify and organize agreements based on counterparties, document types, and key terms. This speeds up the identification of all ISDA agreements involving a specific counterparty.

- Automated Clause Extraction: Advanced natural language processing (NLP) can identify and extract clauses, including ATEs, across all agreements. This allows teams to quickly assess triggers and determine close-out rights.

- Centralized Repository with API Access: A centralized, searchable repository provides quick access to all agreements, and APIs enable seamless integration with other systems for data extraction and analysis.

- Automated Notifications: Once triggers like ATEs are identified, automated workflows can generate notifications with the required information, ensuring compliance with procedural requirements.

- Real-time Netting and Set-off Analysis: With structured data extracted from agreements, real-time analysis of netting sets and set-off rights becomes possible, enabling informed decision-making.

In the high-stakes world of banking, particularly during major market events like a bank bankruptcy, the ability to quickly and accurately navigate ISDA agreements is critical. The chaotic scramble that would traditionally occur can be transformed into a streamlined process with IDP and agreement digitization solutions like Agreements IDP for ISDAs. By automating document retrieval, clause extraction, and notification workflows, banks can significantly reduce their response time and mitigate risks effectively.

Make sure your bank is prepared for the next market storm by digitizing your ISDA agreements today.

For more information

Kinetix is leading the way in Smart Documentation solutions and Intelligent Document Processing (IDP), delivering AI-based services that transform data trapped in documentation into insights, while driving efficiency and reduced costs. For more information about Kinetix IDP, contact Mark Zurada at [email protected].