Real-time compliance decision system for use during trade booking or post analysis

Kinetix Compliance Suite offers a rich,

rules-based engine accessible from various interfaces

Pre or Post Trade

Audit History

Auditable history on why specific decisions were made

Centralized rules

Coverage across the product stacks

Integrated

Compliance, Digital Library, and Trade Hub products are interoperable or standalone

Trade Reporting

MIFID II, EMIR, DODD Frank, Canada, MAS, SFTR

Record keeping

MIFID II compliant full audit history Archiving Storage

Rules Engine

Customizable rules allowing business to improve business conduct.

AI Assurance

Identify errors and omissions.

Over/Unre reporting.

Avoid duplications.

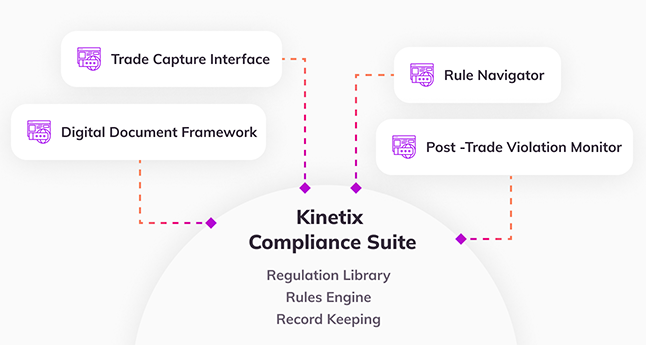

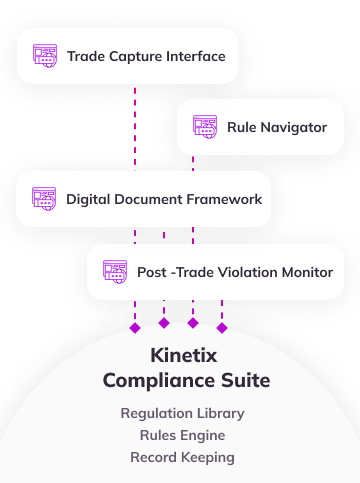

Components and Logical Flow

Kinetix simplifies your trade capture across electronic and voice executions, defaults the trade details so you capture it right at the point of entry, routes the trade through its workflow, and supports exception management for quick resolutions.

Rules Engine

Kinetix Compliance Suite uses a rules engine to improve business controls and compliance for front to back efficiency. The business rules are client specific and constructed together with business analysts.

External Reporting Compliance

Trades are marked with reporting jurisdiction and validated at the time of booking

Product Taxonomy

Trades are stamped to verify product categories for use in reporting and improving front office trade booking compliance

Trader Mandates/Limits Checking

Enables trading supervisors to control and verify business conduct as defined by regulators

Sanctions and Violations Monitoring

Globally restricted events are checked as trades are captured and can be either blocked or alerts raised

The Challenge

A major company wanted to implement a process that quickly scanned daily trade activity across net class for potential compliance viloations

The Solution

Through our compliance rules engine, we provided a solution with a violations processor to scan all trade acivity and run the results against a compliance rule set to generate a list of potential violations.

The Result

Our client was able to easily catch and remediate compliance violations daily, avoiding potential reulatory fines.

Through our compliance rules engine, we provided a solution with a violations processor to scan all trade acivity and run the results against a compliance rule set to generate a list of potential violations.

The Solution

The Challenge

A major company wanted to implement a process that quickly scanned daily trade activity across net class for potential compliance viloations

The Solution

Through our compliance rules engine, we provided a solution with a violations processor to scan all trade acivity and run the results against a compliance rule set to generate a list of potential violations.

The Result

Our client was able to easily catch and remediate compliance violations daily, avoiding potential reulatory fines.